CASE NAME: Commissioner of Income Tax (International Taxation) v. Clifford Chance Pte Ltd

CASE NUMBER: ITA No. 353/2025 and ITA No. 354/2025

COURT: High Court of Delhi

DATE: 04 December 2025

QUORUM: Hon’ble Mr. Justice V. Kameswar Rao, Hon’ble Mr. Justice Vinod Kumar

FACTS

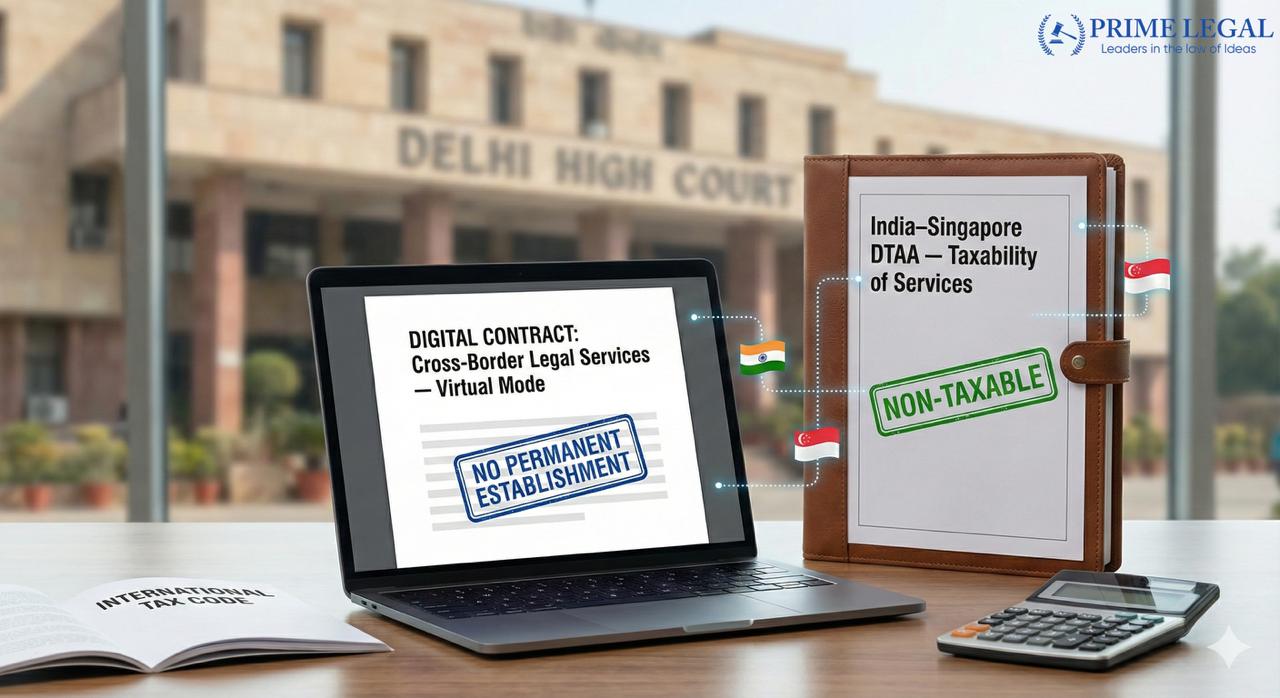

The tax authorities took the ITAT’s decision from March 14, 2024, to the Delhi High Court under Section 260A of the Income Tax Act. They went after Clifford Chance Pte Ltd, a Singapore company that gives legal advice to Indian clients, over assessment years 2020-21 and 2021-22. The firm reported no income in India from those client payments, but the Assessing Officer said it had set up a service permanent establishment here under Article 5(6) of the India-Singapore tax treaty—wanting to add about ₹15.55 crore for one year and ₹7.98 crore for the other.

In 2020-21, two staff members spent 120 days in India altogether, but the company argued most of that was holidays, pitching for business, or days with no actual client work—only 44 days counted as real service time, short of the 90-day limit in the treaty. The next year, nobody from the firm even visited India; everything was done remotely. The Dispute Resolution Panel stuck with the officer’s view, but the ITAT threw it out, saying services had to be done through people actually in India, and there was no rule in the treaty for some “virtual” setup without that. Around December 2025, the High Court backed the ITAT fully and dismissed the appeals. It agreed those 44 days didn’t cross the line after pulling out the non-work time, and made clear that Article 5(6)(a) needs hands-on presence in India to count services as happening “within” the country—no room for taxing remote work on its own.

ISSUES

- Whether the Income Tax Appellate Tribunal erred in holding that the respondent did not constitute a service Permanent Establishment in India under Article 5(6) of the India-Singapore Double Taxation Avoidance Agreement.

- Whether the Income Tax Appellate Tribunal erred in holding that the respondent did not constitute a virtual service Permanent Establishment in India for services rendered remotely.

LEGAL PROVISIONS

- Section 9 and Section 90 of the Income Tax Act, 1961

- Article 5(6) and Article 7 of the India–Singapore DTAA

- OECD Model Tax Convention and Commentary

ARGUMENTS

PETITIONER

The tax authorities maintained that the ITAT wrongly deducted vacation days, business development time, and overlapping days when tallying up the 90-day limit under Article 5(6)(a) of the DTAA. They insisted the employees’ full 120 days in India for AY 2020-21 clearly triggered a service PE.

For AY 2021-22, the Revenue argued physical presence isn’t needed anymore in today’s digital world. They claimed ongoing legal advice from abroad to Indian clients still carved out a virtual service PE, pointing to global trends, OECD papers, and court rulings that back economic or virtual footprints.

RESPONDENT

The respondent’s stand was that Article 5(6) of the India–Singapore DTAA hinges on services being actually performed in India by employees who are physically present here. On this footing, only those days when chargeable services were in fact rendered to clients in India could be brought into the 90‑day computation, whereas days spent on vacation, internal meetings, or business development activities fell outside the scope of “furnishing services” and therefore could not be counted.

For AY 2021–22, the respondent argued that the treaty, as presently drafted, does not incorporate any notion of a “virtual” service PE. In its submission, policy debates, OECD materials, or unilateral domestic law changes on digital or economic presence cannot be used to read into the DTAA a deeming fiction that the contracting states themselves have not agreed to, and hence remote services rendered entirely from outside India could not, by themselves, give rise to a service PE.

ANALYSIS

The Delhi High Court took a close look at Article 5(6) of the India-Singapore DTAA and made it clear that it calls for services to be furnished “within” India by employees or personnel who are actually there on the ground. The court ruled that this wording demands physical presence during the time services are being performed—no shortcuts around that.

It backed the ITAT’s view that just having employees in India doesn’t automatically create a service PE; the key is whether they were truly delivering services to clients. Days lost to vacations, chasing new business, or simple overlaps can’t be lumped together to hit the 90-day mark under the treaty.

When it came to the virtual service PE idea, the court shut that down flat against the Revenue’s push. The DTAA has no clause for it, plain and simple, and judges can’t invent one just because digital services are booming these days. Finally, the court drove home that under Section 90(2) of the Income Tax Act, the treaty terms trump domestic rules every time. OECD reports and global shifts might carry weight as guidance, but they don’t get to rewrite what’s clearly spelled out in the agreement.

JUDGEMENT

The High Court rejected both of the Revenue’s appeals outright. It fully endorsed the ITAT’s conclusion that Clifford Chance had no permanent establishment—or any virtual equivalent—in India during AYs 2020–21 and 2021–22. Which meant the firm walked away with all its service receipts tax-free in India.

CONCLUSION

This ruling firmly establishes that taxing rights under international treaties must adhere strictly to the treaty’s plain language—no stretching or reinterpretation permitted. The Delhi High Court blocked the Revenue’s bid to broaden what counts as a service permanent establishment, keeping things steady and predictable for cross-border taxation.

It sharply separates wishful thinking about the digital world from what’s actually on the books right now. Treaties won’t catch remote or virtual services until countries rewrite them to say so outright, so hands-on work inside India stays the gold standard for pinning down a service PE. The decision hands multinational firms a solid roadmap for navigating Indian tax rules under these pacts.

“PRIME LEGAL is a full-service law firm that has won a National Award and has more than 20 years of experience in an array of sectors and practice areas. Prime legal falls into the category of best law firm, best lawyer, best family lawyer, best divorce lawyer, best divorce law firm, best criminal lawyer, best criminal law firm, best consumer lawyer, best civil lawyer.”

WRITTEN BY: ARCHITHA MANIKANTAN