INTRODUCTION AND BACKGROUND

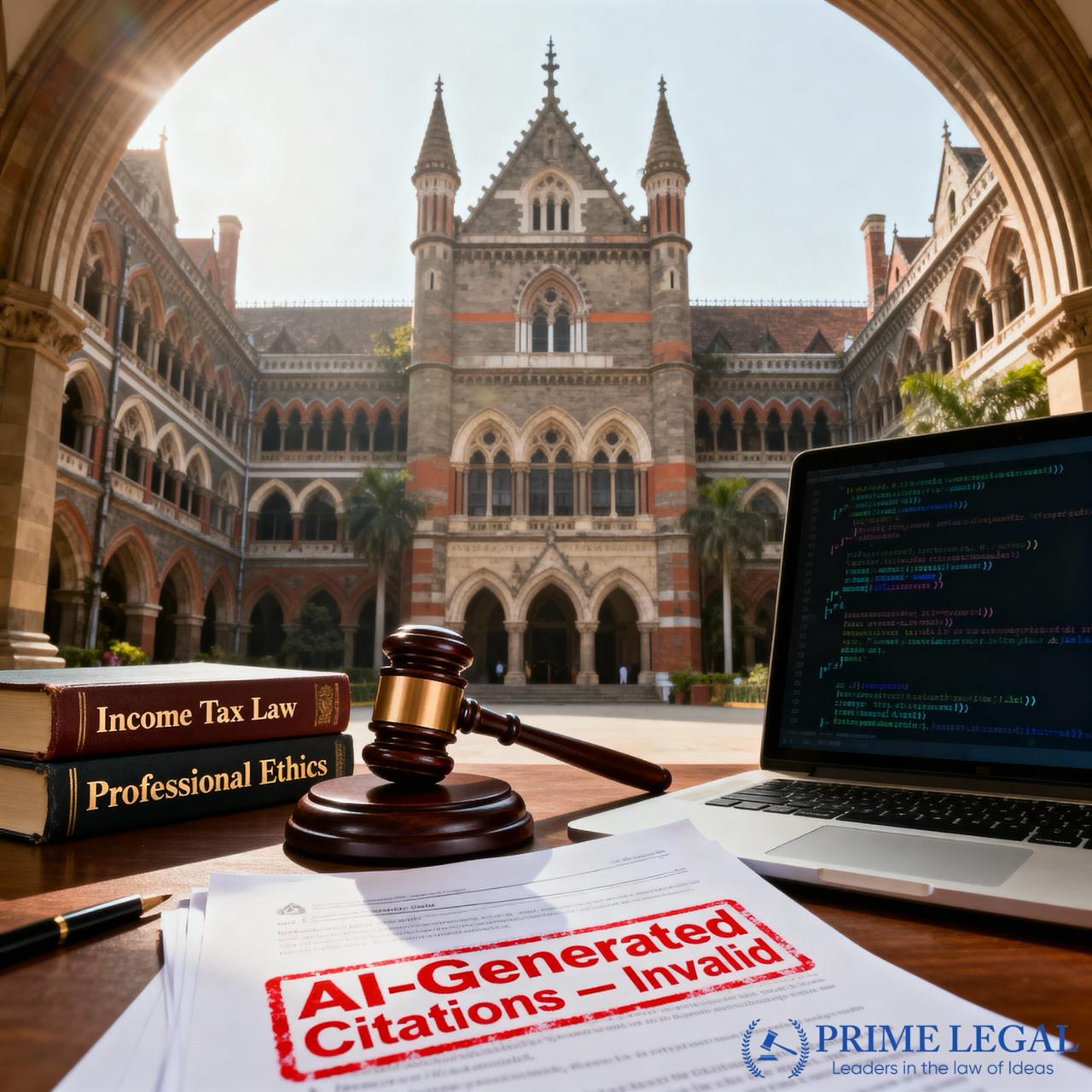

In the case of KMG Wires Private Limited V. The National Faceless Assessment Centre, Delhi and Others [writ petition (l) no. 24366 of 2025], the Bombay High Court quashed an Income Tax Assessment order passed under section 143(3) read with Section 144B of the Income Tax Act, 1961 for the Assessment Year 2023-24 against KMG Wires Private Limited on violation of Principles of Natural Justice, unsuitable reliance on non-existent, AI generated judicial decisions. It also set aside the Demand Notice under Section 156, and Penalty Proceedings under Section 274 read with Section 271AAC of the Act. The Court further remand the matter back to the Assessing Officer for a fresh and fair assessment.

KEY POINTS

- The Assessment order has raised KMG’s total income from Rs. 3.09 crore to Rs. 27.91 Crore for the Assessment Year 2023-24. Therefore the petitioner challenged the order under Sections 143(3) (Scrutiny assessment) and 144B (Faceless assessment) of the Income Tax Act, 1961 and also corresponding Notice of Demand under Section 156 and penalty proceedings under Sections 274 and 271AAC.

- The court observed that the disputed assessment include two major additions. Firstly the purchase worth of Rs. 2.16 crores from Dhanlaxmi Metal Industries, Surat which the assessing officer claimed that the supplier failed to respond to the notice under Section 133(6) of the Income Tax Act, 1961. Under this section a notice can be issued by the Income Tax department to the Tax Payers or third parties such a banks to request information for Tax inquires which may be considered useful for inquiry or proceedings under Income Tax Act, 1961.

- Secondly while calculating the peak balance in respect of loans from directors, opening balance was considered and for the same reliance has been placed on 3 judicial decisions which are in non- existence.

- However in respect to dispute no. 1, the company presented the proof that the supplier has replied to the notice, confirming the transactions with other documents which the assessing officer overlooked and recorded as no reply received.

- In respect of dispute no. 2, no show cause notice explaining the addition was issued depriving the company to be heard, hence a clear violation of Principle of Natural Justice.

- Featuring the modern concern, the court consisted of Justices BP Colabawalla and Amit S Jamsandekar stated that while AI can play a vital role in helping with legal research but it should not be trusted blindly. It should be independently be verified, as unverified AI generated references may lead to errors.

- The Bombay HC ruled that submissions of non-existent case laws is a violation of professional and ethical obligations of a Tax officer as it may mislead the case. Hence as a result of misconduct of the tax officer the court issued formal censure against the concerned Tax officer.

- Accountability in legal profession cannot be negotiated as fake case citation not only hampers the judicial process but also sets a dangerous precedent, especially in faceless assessments where transparency and fairness is a crucial entity.

- The court stated judicial decisions are based on factual and legal correctness thereby introducing false references distorts the very foundation of justice.

RECENT DEVELOPMENTS

Hon’ble Supreme Court has made warnings as use of AI can lead to ethical risk in legal education and research. B. R. Gavai J. (SCJ) stressed that legal education must emphasise verification of AI generated contents as AI tools must be supplements and not be substitutes to human legal reasoning. In a petition before the High Court of Delhi the filing was found to rely on legal authorities that does not exist. The matter involved the case of Greenopolis Welfare Association v. Narender Singh and ors [CM(M) 1909/2025, CM APPL. 61372/2025 & CM APPL. 61371/2025] Legal experts warned that unchecked use of AI-generated legal references undermines professional standards, credibility, and trust in the courts.

CONCLUSION

In modern days the use of AI generated tools are of great importance. But when it comes to reliance to it’s facts and the references it should be checked independently and manually. When the AI generated references are to guide judicial proceedings it is of crucial importance that it must be rechecked before submitting to the authority. In our present case the quorom focused on how fake citations mislead the judicial proceedings, and set a wrong precedent. Therefore anyone not paying attention to the very foundation of justice must be said to have performed professional misconduct.

“PRIME LEGAL is a full-service law firm that has won a National Award and has more than 20 years of experience in an array of sectors and practice areas. Prime legal falls into the category of best law firm, best lawyer, best family lawyer, best divorce lawyer, best divorce law firm, best criminal lawyer, best criminal law firm, best consumer lawyer, best civil lawyer.”

Written By- Susmita Roychowdhury