TITLE Hathiyabhai Dudhabhai Khunti Versus State of Gujarat Decided On September 21, 2023 6544 of 2023 CORAM: Hon’ble Justice Mr Hasmukh

Title: T. Mahendran v. The National Insurance Company Decided on: 21st September, 2023 WRIT PETITION NO. 4283 OF 2012 CORAM: THE HON’

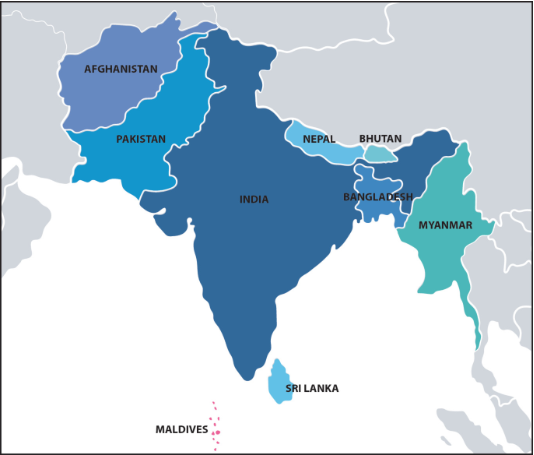

Introduction: The case of Seema Haider has been on the news for a few months now. The background of the case revolves around Seema Haider, a Pakist

Title: Mudit Nagpal v. State of Rajasthan Date of Decision: September 19, 2023 Case ID: D.B. Civil Writ Petition No. 14249/2023 Presiding Judges: H

Bombay High Court Goa grants injunction preventing interference in construction work Title: Goa University v. Haroon Ibrahim Decided on: August

ABSTRACT The World Intellectual Property Organisation was initially formed on the notion of ensuring administrative cooperation among the intell

Title: Mahant Prasad Ram Tripathi vs. State of U.P. Decided on : 23- August-2023. CRIMINAL REVISION NO. – 935 of 2023 CORAM:�

The Bombay High Court quashes the rejection letter of teacher by the Education Department, directs them to grant the approval of his appointment as

The Bombay High Court at Goa grants bail to accused for not being a flight risk, having no criminal antecedents and after considering that the tria

Case Title: Sugurappa @ Sugurayya Swami v. The State Of Karnataka Case NO: Criminal Petition No.201248 of 2021 Date of Order: 03-08-2023 INTRODUCTI