Introduction Drug abuse and the use of substances have emerged as one of the most pressing problems we face today, presenting itself both as a so

Introduction: In a huge surprise move the Supreme Court of India has set aside its May 2, 2025 judgment which had ordered the liquidation of Bhusha

Introduction: In a major decision the Supreme Court of India has ruled that access to safe, motorable and well maintained roads is a component of

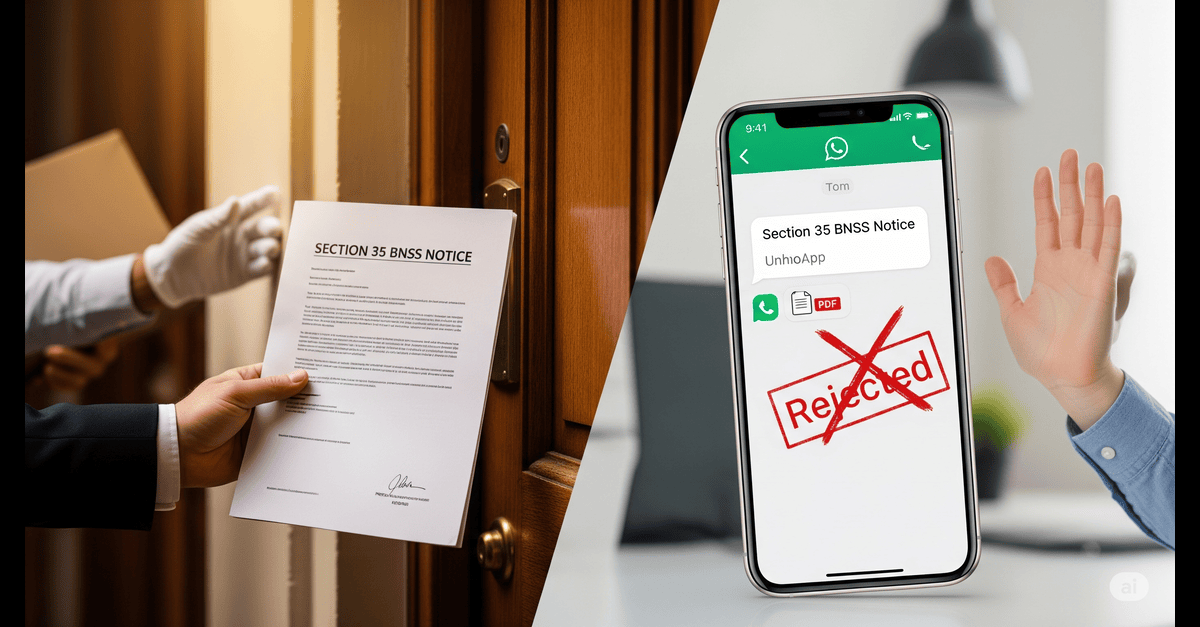

Case Name: Satinder Kumar Antil v. Central Bureau of Investigation and Anr. Case Number: In 2025 IA No. 63691 of 2022 in MA No. 2034 and in 2021 in

Case Name: Ferrero S.p.A. et al. v. M.B. Enterprises. Case Number: CS (Community) 593 of 2021. Judgment Date: July 28, 2025. Judge/Bench: Justice S

Introduction In a ruling which brought forward the court’s stand on the issue, the Chhattisgarh High Court reported that to say “I love you”

Introduction Rajasthan High Court has put forth a strong stand against the present judicial employees’ strike, which it terms as illegal and an i

Case Name: Manohar et al v. State of Maharashtra et al. Case Numbers: Civil Appeal no. in 2025 (which is out of SLP(C) Diary No. 26900 of 2023).

Case name: West Bengal State vs. Radha Kanta Bera. Radha Kanta Bera and the State of West Bengal. Case number: Criminal Appeal (DB) No. 169 of 2023

Introduction On the 25th of July 2025 the Supreme Court of India in the case of Sukdeb Saha v. State of Andhra Pradesh gave what is being called a