Case Title: C Alagappan v The State Case No: Crl.O.P.Nos.22333 & 24313 of 2023 Decided on: 18th December, 2023 CORAM: THE HON’BLE MR. JUSTICE

Case Title: Eicher Motors Ltd v Nitin Service Point and Automobiles Case No: C.S. (Comm.Div.) No.77 of 2023 Decided on: 22nd November, 2023 CORAM:

Case Title: UT ADMINISTRATION OF LAKSHADWEEP V. MOHAMMAD FAIZAL & ORS. Case No: CRIMINAL APPEAL NO.2501 OF 2023 (Arising out of SLP (Crl.)

Case Title: RABEENDRA KUMAR DHAKAD V. HT MEDIA LTD & ANR. Case No: SPECIAL LEAVE PETITION TO APPEAL © NO(S). 394/2024 Decided on: 8 JANUARY,

Case Title: MBL Infrastructures Limited v. Delhi Metro Rail Corporation Case No: O.M.P. (COMM) 311/2021 Decided on: 12th December, 2023 CORAM: T

Case Title: T.V. Today Network Limited v. Sameet Thakkar & Anr. Case No: CS(OS) 123/2020 Decided on: 20th December, 2023 CORAM: THE HON’BLE

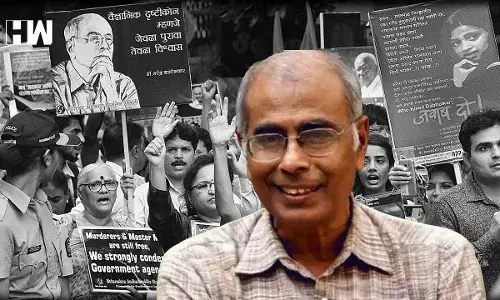

Case Title: Mukta Dabholkar & Anr. Vs. The Central Bureau of Investigation & Ors. Case No: SLP (Crl) No(s) 6539/2023 Decided on: 18th Apr

Case Title: Mrs. Zeba Mohasin Pathan, Easak Gulab Pathan V. State of Maharashtra Case No: Writ Petition No. 5185 of 2018 Decided on: 5 January, 2

Case Title: R.S. Sasikumar vs State Of Kerala Case No: (2023) 08 KL CK 0086 Decided on: 9th August 2023 CORAM: A. J. Desai, C. J. Facts of the C

Case Title: UNION OF INDIA…. V. M/S PANACEA BIOTEC LIMITED Case No: FAO (OS) (COMM) 83/2020, CM APPL. 15008/2020, CM APPL. 15009/2020, CM A